If you’re considering whether to go to university to continue your education, it’s likely that the cost of studying a degree has crossed your mind.

University fees in the UK typically increase year on year, so they are only getting more expensive. When you couple this with the overall expenses associated with going to university, it’s easy to see why many determined learners consider alternate routes to achieve their career goals.

For instance, many would-be university students opt for online courses that allow them to enter their chosen line of work or study their desired subject for far less expense.

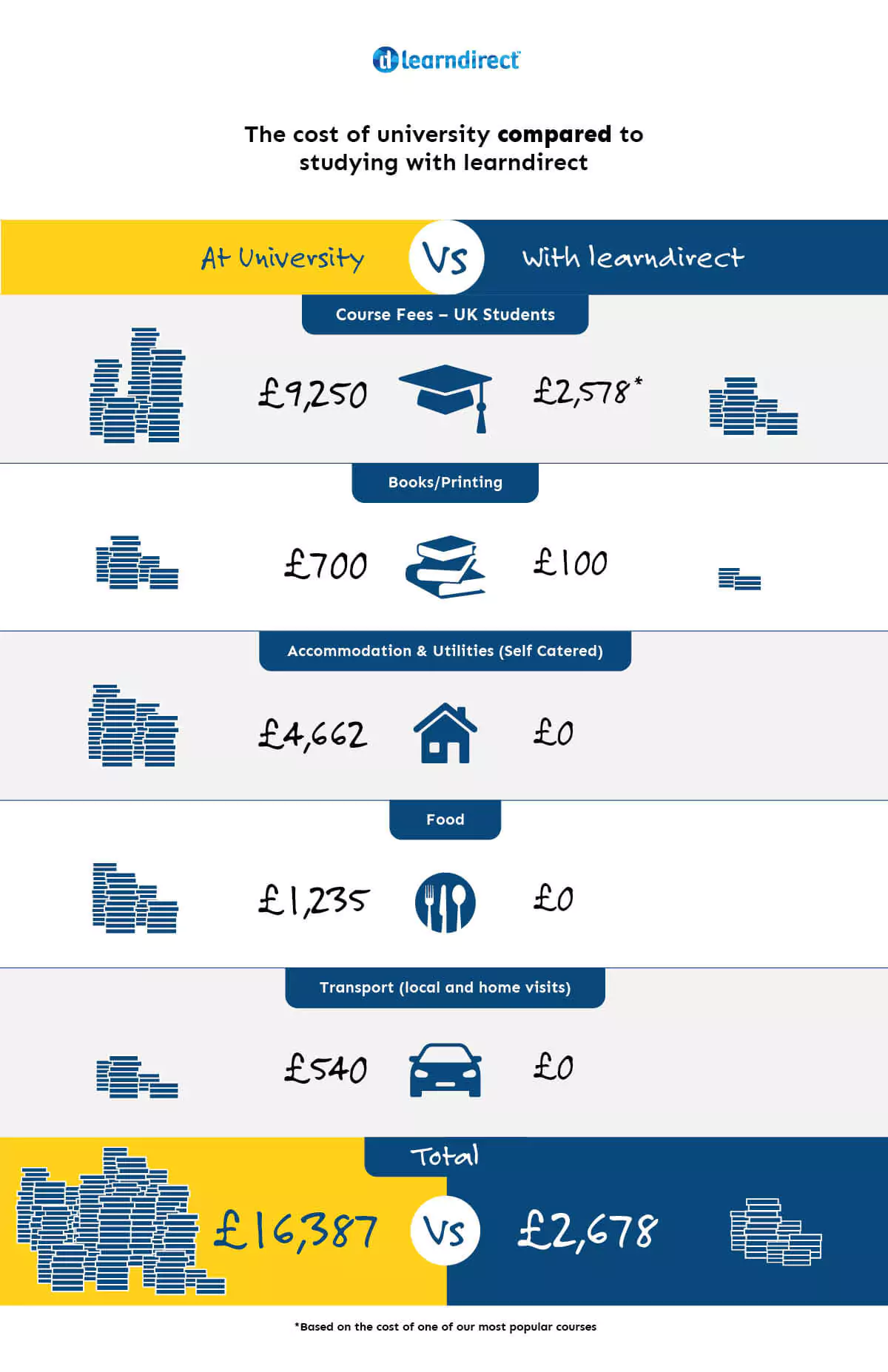

It can be hard to know which option is best for you and as it’s such a big decision it’s wise to take the time to give it the appropriate amount of thought. A great place to start is breaking down the costs of university and online study, to see exactly what each option involves.

How Much Does University Cost?

When people think about university costs, they immediately think of tuition fees. However, the costs of going to university extend far past this. As there are so many other elements you need to factor in.

Open Days

This is before you’ve even enrolled on a university degree. Open days are a big expense that most learners don’t think about. Granted some people get help with this from their parents, however, that’s not always an option for every student. So you need to take this into account early on if finances are something you need to closely monitor.

Open days are an important part of the university process. Visiting the campus you intend to study at or the ones you have shortlisted is a great way to get a feel for the one that suits you best.

There is no charge to attend open days. Though, in many cases, the universities you will visit could be some distance away from where you currently live. This means you will need to factor in the cost of travel and accommodation if needed while you’re there.

Accommodation and Living Expenses

As you will be at university typically for at least three years, you need to consider the costs of your living expenses while you’re there. If you are moving away to university, the cost of accommodation needs to be taken into account.

While your rent is a big part of this, it also includes the cost of bills, food, laundry and household supplies. Not to mention your travel expenses to and from campus each day if it isn’t within walking distance. The cost of your rent and other living expenses will depend on the type of accommodation you choose and the location you’re in. For instance, London would generally be more expensive than other locations.

If you’re choosing to live at home, travel costs will likely be higher as you will generally be further away. Socialising is also a big part of the university experience, so you’ll need to factor this in if you wish to meet and mingle with other students. Thankfully, there are usually many student deals and discounts on offer that you can take advantage of.

Stationary and Course Materials

When attending a physical course, you need to come prepared with notepads, pens and anything else that you need to take down notes. You will also be expected to purchase textbooks for your wider reading, which can be rather expensive. Just one book alone can set you back up to £50!

You may be able to find some in the university library, but you’ll only be able to keep a hold of them for a short time. There will also only be a limited supply of library books and you won’t be the only one looking to get your hands on one. It’s also often the case that books are reserved by other people for weeks at a time, which can be frustrating.

Shopping around for second-hand books is a great way to reduce this cost. Though the person selling them will no doubt try to recoup some of the cost they had to pay so they might still be fairly expensive. You will also need to keep in mind that second-hand books will likely not be the latest edition.

Depending on the course you study you may also need to purchase additional supplies. Medical courses for example tend to require specialist equipment, whereas accounting courses necessitate certain supplies to complete projects.

Another hidden cost that ends up being quite expensive is the cost to print your work. While most work can be submitted online now, you will still have to print certain pieces, like your dissertation.

Loans

As a UK student, you can cover the cost of your tuition fees with a tuition fee loan. While the amount that is offered by the loan providers depends on the course you’re taking, most courses charge a maximum of £9,250 per year. If you choose this loan option, the money is paid directly to the university to cover the course costs.

If you’re an international student looking to study in the UK, your tuition fees can be much higher. They can start at around £10,000 and can reach anywhere up to £38,000 and over depending on what you study. Unlike UK students though, you won’t be able to get a tuition fee loan to help you cover these fees.

There is another loan UK students can take advantage of called a maintenance loan that helps cover the cost of their living expenses. Which, as we’ve established, can mount up considerably. Unlike the tuition fee loan, this gets paid into your bank account. You’ll receive instalments each term and you can use them as you need to.

The amount you will receive is determined by your household income. Many students receive enough to cover their rent, however, they have to supplement the rest through part-time employment.

You won’t have to pay these loans back until you earn over £25,725 a year and if you don’t earn this much in your career, you won’t have to pay them back at all. If you do earn over this amount, you will pay 9% each year of what you earn over the threshold.

Alternatively, there are other sources of funding certain students may be able to apply for such as bursaries, grants and scholarships. These are offered by universities, companies, professional associations and charities. You would need to research these options and apply directly to be considered.

How much does it cost to study with learndirect?

Depending on what you’d like to do in your career, taking an online course could be a much cheaper way of getting there.

Reduced Course Fees

Distance learning providers, like learndirect, have fewer overheads to contend with than a brick-and-mortar institution. Classroom education requires teachers to deliver lessons, utilities and a campus large enough to house all the students. These among other expenses all add up and affect what you pay for a course.

Although we don’t have a physical building to study in, you will still benefit from the support of a professional tutor who is an expert in your chosen subject. The course materials have also been designed with the online experience in mind. So unlike other courses that have just been quickly adapted to have an online version, your learning experience will be far more innovative.

With our students learning from home, we only have the online platform to maintain. This is constantly invested in to bring you the best learning experience possible. However, it’s still less expensive than running a physical premise.

This is generally reflected in the price you pay, providing you with great saving opportunities.

Fewer Add-on Expenses

Besides the cost of your course and the computer or laptop you need to complete it on, there really isn’t much else involved. Studying online removes the need to travel or arrange new accommodation as you can study from wherever is convenient for you.

The course materials are also completely online and the work you complete is submitted electronically too. So, there’s no need to buy additional supplies if you don’t want to.

Same Outcome as a Degree

Many online courses can get you into the same line of work as a degree. So not only will you save money on the cost of your education, you can reach your end goal in much less time.

Online courses are studied at your pace. So you can finish it much faster than the allotted timeframe if you need or want to.

For instance, if you wanted to become an accountant, our online AAT Accounting courses can get you into the profession much faster than a three-year accounting degree. In addition to providing you with commercial experience from an accountancy practice. You could also become a zookeeper through our Level 3 (RQF) Zookeeping Diploma or a dental nurse with our NEBDN National Level 3 Diploma in Dental Nursing.

The cost of these courses is much lower than what you’d pay for a degree in the same subject. Plus, online courses often benefit from seasonal discounts, so you could save even more on your education.

You can view the price of these courses on the individual course pages.

Get Started with an Online Course

These are just some of the online courses learndirect provides that enable you to access qualified professions. With the entirety of the costs involved in attending university, it’s easy to see how online courses are the cheaper alternative. However, you need to do your research ahead of enrolling to ensure the course you take will provide the end result you’re after.

If you need help making your decision, our student support advisors are on hand to discuss your options. They know exactly what each of our online courses can lead you into. So, if you’re unsure what course to take to reach your ideal career, they can provide the certainty you’re looking for.

Find out more about the many courses we have available by clicking below. Or speak to our advisors directly by calling 01202 006 464 or by contacting them online here.