AAT Level 3 Bookkeeping: Enrol Today

97.2%

97.2%

- SALE Savings End Midnight Tuesday 10th March

- SALE Savings End Midnight Tuesday 10th March

AAT Level 3 Certificate in Bookkeeping (Q2022)

Key Points

- Take your bookkeeping knowledge to an advanced level

- Climb the ladder into senior roles

- Dive deep into VAT, payroll and reporting

- Completion possible in six months

- Internationally recognised AAT qualification

- 100% online

Studying Your Advanced Course

Are you an experienced Bookkeeper looking to take the next step up in your career? If so, this course is for you.

Designed to build you up to roles like a Senior Bookkeeper or Ledger Manager, this internationally recognised AAT Level 3 Certificate puts you on the path to career progression.

It does this by teaching you how to carry out complex bookkeeping transactions by exploring subjects like advanced bookkeeping, final accounts preparation, and indirect tax in detail.

Being an online course, it’s also ideal for existing bookkeeping professionals who don’t want to take time off work to study. So, you can get qualified for the next step in your career without making changes to your existing schedule.

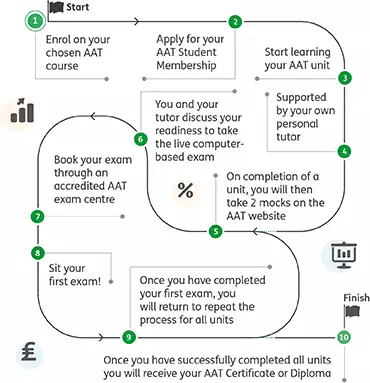

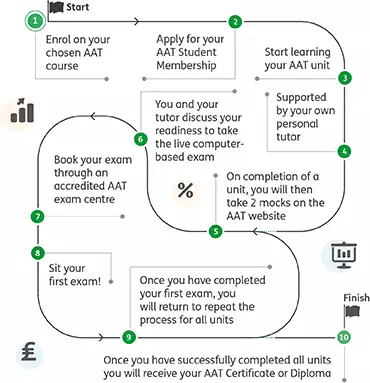

Your 10 Step AAT Learner Journey

Your Career with AAT

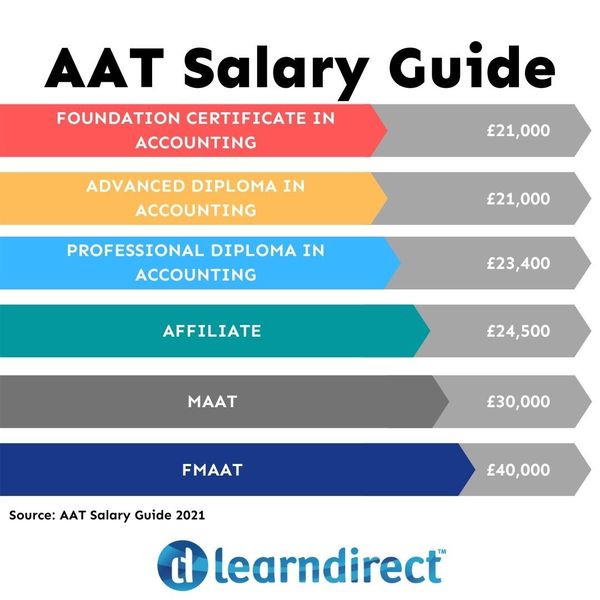

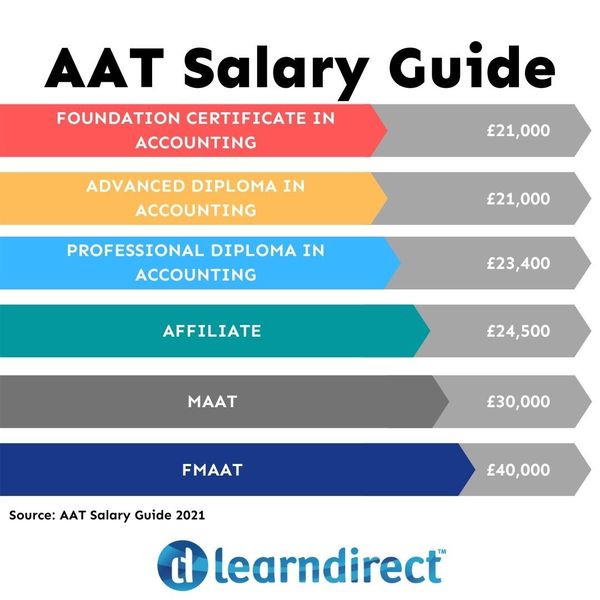

Once you achieve the AAT Level 3 Certificate in Bookkeeping you should aim to apply for Accounts Clerk, Account Manager, or Bookkeeper roles with salaries ranging from £23,000 - £30,000 per year.

Getting Started

This Advanced Certificate in Bookkeeping is accredited and awarded by The Association of Accounting Technicians (AAT). With the input of industry leaders and professionals, it gives you the best possible chance of succeeding in a career in finance.

learndirect is a leading UK distance learning provider. With courses solely based online, you have the flexibility to study when and where best suits your lifestyle.

You can upskill and qualify as a Bookkeeper around your current job or busy family life. With no classes to attend or timetables to stick to, you get to plan your study schedule.

What’s more, you have the assistance of a dedicated online tutor and the ability to access everything you need within an easy-to-use online portal. All your course materials are engaging, diverse and relate to real life financial scenarios. So, you can gain real life experience in preparation for a career in finance.

Additional Fees

As part of your studies, you will need to register with the AAT. You can complete this quickly and easily with the AAT by clicking here.

All computer-based examinations are completed at an AAT-approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams will cost approximately £90-£150+ per exam depending on the exam centre that you choose and are not included in the course fees.

AAT Remote Invigilation

AAT remote invigilation for Q2022 is available to book on the following link.

Modules

This course comprises of 2 compulsory units.

Unit 1: Financial Accounting; Preparing Financial Statements

On completion of this unit, you will:

- Understand the accounting principles underlying final accounts preparation

- Understand the principles of advanced double-entry bookkeeping

- Implement procedures for the acquisition and disposal of non-current assets

- Prepare and record depreciation calculations

- Produce and extend the trial balance

- Produce financial statements for sole traders and partnerships

- Interpret financial statements using profitability ratios

- Prepare accounting records from incomplete information

Unit 2: Tax Processes for Business

On completion of this unit, you will:

- Understand and apply VAT legislation requirements

- Calculate VAT

- Review and verify VAT returns

- Understand principles of payroll

- Report information within the organisation

Entry Requirements

There are no entry requirements for this course, it is open to all.

It is recommended that you have successfully completed the AAT Level 2 Bookkeeping course. If unsure, please check your skill level here.

Minimum Age restriction

You must be aged 16 or above to enrol on this course.

Average completion timeframe

The average time it takes to complete the course is 9-12 months.

Assessment requirements

All units in each qualification will be assessed by AAT Official CBE's (Computer Based Exams).

Exams required

Learners will undergo 2 computer base exams, which will need to be paid for separately to the provider of your choice as they are not included as part of the course fee. Each exam costs approximately will cost approximately £90-£150+.

-Is AAT Registration Required?

AAT Registration for this Level is required for certification and must be paid by the learner directly to AAT.

We ask that you register with AAT within 4 weeks of start the course.

AAT registration for this Level is approximately £94 – please check with AAT for updates.

Additional requirements

You will need a computer or laptop to study the course, and you must secure AAT Membership within 4 weeks of starting the course. Please note that the AAT Membership fee of £94 is not included in the course fee. If you are unsure of what level of qualification is best for you, then take the AAT Skillcheck (link to https://www.aat.org.uk/qualifications-and-courses/skillcheck) Test to find out.

Certification Timeframe

Certification / accreditation for this course is made by AAT.

It can take up to 6 months to receive your certificates and all enquires must be directed to AAT student services.

Course Fees

All course fees to Learndirect, inclusive of all payment plans including our Premium Credit Limited option, must be settled before the final unit will be available.

*You will have access to the course for 24 months.

Assessment

When studying for an AAT qualification, your knowledge and skills will be tested via computer-based assessments (CBAs). These are administered by AAT training providers in assessment centres and run entirely on PCs or laptops. Or you may choose Remote Invigilation Assessment where you can sit your CBA at home or office for convenience. Please check AAT guidelines for IT requirements.

Computer-Based Assessments

AAT’s computer-based assessments are marked in one of three ways:

- Wholly computer marked, and so results will be available automatically

- Partially computer marked and partially human marked, and so results will be available within six weeks

- Wholly human marked, and so results will be available within six weeks

When are you assessed?

You decide where and when you are ready to sit your live assessment.

Once you have completed our online training you will complete revision and mock assessments to ensure that you are confident to sit your CBA and meet the minimum 70% pass mark.

Exam Fees

All computer-based examinations are completed at an AAT-approved external exam centre or via Remote Invigilation. AAT remote invigilation for Q2022 is available through Learndirect - to book on the following link. You can discuss this further with your tutor during your studies, but unit computer-based exams will cost approximately £90-£150+ per exam depending on the exam centre that you choose. Additional fees are paid directly to AAT or your chosen CBE provider and are not included in the Learndirect course fees.

AAT

Upon successful completion of this course, you will be awarded the AAT Level 3 Certificate in Bookkeeping (Qualification Number: 603/6344/7)

AAT works across the globe with around 140,000 members in more than 90 countries. Their members, including students, are represented at every level of the finance and accounting world.

AAT members are ambitious, focused accounting professionals. Many of AAT members occupy senior, well-rewarded positions with thousands of employers – from blue-chip corporate giants to public sector institutions.

AAT qualifications are universally respected and internationally recognised. Organisations hire AAT qualified members for their knowledge, skills, diligence and enthusiasm, because AAT represents the highest standards of professionalism. In short, an AAT qualification is a route to some of the most in-demand skills in the world, and provides their students and members with a professional status to be proud of.

The Association of Accounting Technicians (AAT) is a world-renowned professional body of Accountants with members across 90 countries. As such it is one of the most widely regarded and respected accounting bodies in the world.

Whether you have a small business or want to further your accounting or bookkeeping career, gaining an AAT accredited qualification will give you the skills you need to achieve your goal.

AAT accredited qualifications are also internationally recognised, opening career opportunities around the world, and allowing you to expand your financial horizons in diverse and exciting new ways.

Once you achieve the AAT Level 3 Certificate in Bookkeeping you should aim to apply for Accounts Clerk, Account Manager, or Bookkeeper roles with salaries ranging from £23,000 - £30,000 per year.

Frequently Asked Questions

- SALE Savings End Midnight Tuesday 10th March

- SALE Savings End Midnight Tuesday 10th March

AAT Level 3 Certificate in Bookkeeping (Q2022)

Key Points

- Take your bookkeeping knowledge to an advanced level

- Climb the ladder into senior roles

- Dive deep into VAT, payroll and reporting

- Completion possible in six months

- Internationally recognised AAT qualification

- 100% online

Studying Your Advanced Course

Are you an experienced Bookkeeper looking to take the next step up in your career? If so, this course is for you.

Designed to build you up to roles like a Senior Bookkeeper or Ledger Manager, this internationally recognised AAT Level 3 Certificate puts you on the path to career progression.

It does this by teaching you how to carry out complex bookkeeping transactions by exploring subjects like advanced bookkeeping, final accounts preparation, and indirect tax in detail.

Being an online course, it’s also ideal for existing bookkeeping professionals who don’t want to take time off work to study. So, you can get qualified for the next step in your career without making changes to your existing schedule.

Your 10 Step AAT Learner Journey

Your Career with AAT

Once you achieve the AAT Level 3 Certificate in Bookkeeping you should aim to apply for Accounts Clerk, Account Manager, or Bookkeeper roles with salaries ranging from £23,000 - £30,000 per year.

Getting Started

This Advanced Certificate in Bookkeeping is accredited and awarded by The Association of Accounting Technicians (AAT). With the input of industry leaders and professionals, it gives you the best possible chance of succeeding in a career in finance.

learndirect is a leading UK distance learning provider. With courses solely based online, you have the flexibility to study when and where best suits your lifestyle.

You can upskill and qualify as a Bookkeeper around your current job or busy family life. With no classes to attend or timetables to stick to, you get to plan your study schedule.

What’s more, you have the assistance of a dedicated online tutor and the ability to access everything you need within an easy-to-use online portal. All your course materials are engaging, diverse and relate to real life financial scenarios. So, you can gain real life experience in preparation for a career in finance.

Additional Fees

As part of your studies, you will need to register with the AAT. You can complete this quickly and easily with the AAT by clicking here.

All computer-based examinations are completed at an AAT-approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams will cost approximately £90-£150+ per exam depending on the exam centre that you choose and are not included in the course fees.

AAT Remote Invigilation

AAT remote invigilation for Q2022 is available to book on the following link.

Modules

This course comprises of 2 compulsory units.

Unit 1: Financial Accounting; Preparing Financial Statements

On completion of this unit, you will:

- Understand the accounting principles underlying final accounts preparation

- Understand the principles of advanced double-entry bookkeeping

- Implement procedures for the acquisition and disposal of non-current assets

- Prepare and record depreciation calculations

- Produce and extend the trial balance

- Produce financial statements for sole traders and partnerships

- Interpret financial statements using profitability ratios

- Prepare accounting records from incomplete information

Unit 2: Tax Processes for Business

On completion of this unit, you will:

- Understand and apply VAT legislation requirements

- Calculate VAT

- Review and verify VAT returns

- Understand principles of payroll

- Report information within the organisation

Entry Requirements

There are no entry requirements for this course, it is open to all.

It is recommended that you have successfully completed the AAT Level 2 Bookkeeping course. If unsure, please check your skill level here.

Minimum Age restriction

You must be aged 16 or above to enrol on this course.

Average completion timeframe

The average time it takes to complete the course is 9-12 months.

Assessment requirements

All units in each qualification will be assessed by AAT Official CBE's (Computer Based Exams).

Exams required

Learners will undergo 2 computer base exams, which will need to be paid for separately to the provider of your choice as they are not included as part of the course fee. Each exam costs approximately will cost approximately £90-£150+.

-Is AAT Registration Required?

AAT Registration for this Level is required for certification and must be paid by the learner directly to AAT.

We ask that you register with AAT within 4 weeks of start the course.

AAT registration for this Level is approximately £94 – please check with AAT for updates.

Additional requirements

You will need a computer or laptop to study the course, and you must secure AAT Membership within 4 weeks of starting the course. Please note that the AAT Membership fee of £94 is not included in the course fee. If you are unsure of what level of qualification is best for you, then take the AAT Skillcheck (link to https://www.aat.org.uk/qualifications-and-courses/skillcheck) Test to find out.

Certification Timeframe

Certification / accreditation for this course is made by AAT.

It can take up to 6 months to receive your certificates and all enquires must be directed to AAT student services.

Course Fees

All course fees to Learndirect, inclusive of all payment plans including our Premium Credit Limited option, must be settled before the final unit will be available.

*You will have access to the course for 24 months.

Assessment

Assessment

When studying for an AAT qualification, your knowledge and skills will be tested via computer-based assessments (CBAs). These are administered by AAT training providers in assessment centres and run entirely on PCs or laptops. Or you may choose Remote Invigilation Assessment where you can sit your CBA at home or office for convenience. Please check AAT guidelines for IT requirements.

Computer-Based Assessments

AAT’s computer-based assessments are marked in one of three ways:

- Wholly computer marked, and so results will be available automatically

- Partially computer marked and partially human marked, and so results will be available within six weeks

- Wholly human marked, and so results will be available within six weeks

When are you assessed?

You decide where and when you are ready to sit your live assessment.

Once you have completed our online training you will complete revision and mock assessments to ensure that you are confident to sit your CBA and meet the minimum 70% pass mark.

Exam Fees

All computer-based examinations are completed at an AAT-approved external exam centre or via Remote Invigilation. AAT remote invigilation for Q2022 is available through Learndirect - to book on the following link. You can discuss this further with your tutor during your studies, but unit computer-based exams will cost approximately £90-£150+ per exam depending on the exam centre that you choose. Additional fees are paid directly to AAT or your chosen CBE provider and are not included in the Learndirect course fees.

Qualifications

AAT

Upon successful completion of this course, you will be awarded the AAT Level 3 Certificate in Bookkeeping (Qualification Number: 603/6344/7)

AAT works across the globe with around 140,000 members in more than 90 countries. Their members, including students, are represented at every level of the finance and accounting world.

AAT members are ambitious, focused accounting professionals. Many of AAT members occupy senior, well-rewarded positions with thousands of employers – from blue-chip corporate giants to public sector institutions.

AAT qualifications are universally respected and internationally recognised. Organisations hire AAT qualified members for their knowledge, skills, diligence and enthusiasm, because AAT represents the highest standards of professionalism. In short, an AAT qualification is a route to some of the most in-demand skills in the world, and provides their students and members with a professional status to be proud of.

The Association of Accounting Technicians (AAT) is a world-renowned professional body of Accountants with members across 90 countries. As such it is one of the most widely regarded and respected accounting bodies in the world.

Whether you have a small business or want to further your accounting or bookkeeping career, gaining an AAT accredited qualification will give you the skills you need to achieve your goal.

AAT accredited qualifications are also internationally recognised, opening career opportunities around the world, and allowing you to expand your financial horizons in diverse and exciting new ways.

Once you achieve the AAT Level 3 Certificate in Bookkeeping you should aim to apply for Accounts Clerk, Account Manager, or Bookkeeper roles with salaries ranging from £23,000 - £30,000 per year.

Frequently Asked Questions

97.2%

97.2%

learning

learning hours

If you find this course cheaper anywhere

If you find this course cheaper anywhere