AAT Level 2 Certificate: A Step Towards Accounting

97.2%

97.2%

- SALE Savings End Midnight Tuesday 13th January

- SALE Savings End Midnight Tuesday 13th January

AAT Level 2 Certificate in Accounting (Q2022)

Key Points

- Take the first step towards an accounting career

- Develop a solid foundation in finance administration

- Learn about double-entry bookkeeping, using journals and controlling accounts

- Readies you for junior and entry-level accounting roles

- An internationally recognised AAT qualification

- Completion possible within a year

Studying Your Foundation Course

This course is perfect for anyone looking to put their best foot forward when it comes to starting the study journey into an accounting career. With no prior knowledge or experience required, you can get started right away and gain everything you need to get your foot in the door of the financial world.

This is the first of many available qualifications and, as an online course, it can be studied easily from home. You also don’t have to wait until you achieve higher level accounting qualifications to start working.

During the course, you will study modules like bookkeeping transactions and controls, the elements of costing and the business environment. All of this and more will give you the solid foundation you need to begin managing client books or handling your own business finances.

This online course was also developed in collaboration with accountancy employers, so you know you’re learning the skills you need to succeed in the industry.

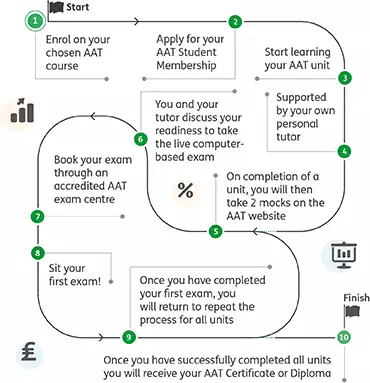

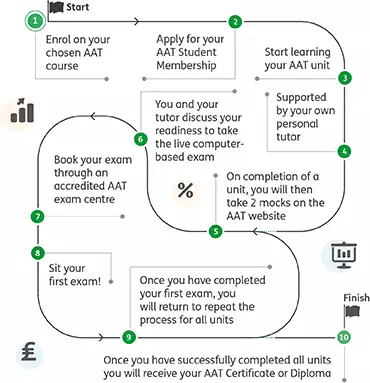

Your 10 Step AAT Learner Journey

Your Career with AAT

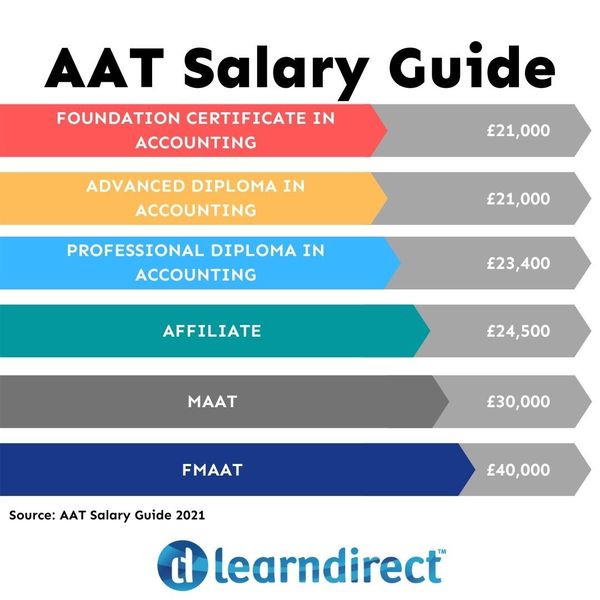

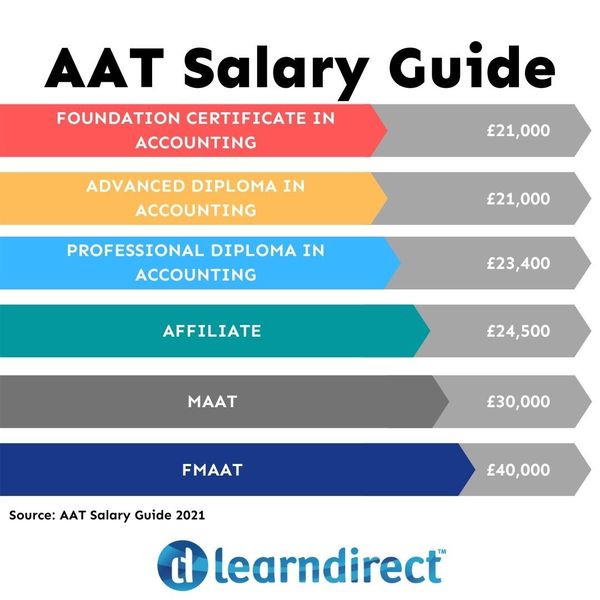

Once you achieve the AAT Level 2 Certificate in Accounting you should aim to apply for Trainee Accountant, or Junior Accountant roles with salaries ranging from £20,000 - £27,000 per year.

Getting Started

learndirect is a leading UK distance learning provider. This Level 2 Certificate in Accounting is accredited by The Association of Accounting Technicians (AAT). Developed with the input of industry leaders and professionals, it gives you the best possible chance of succeeding in a career in finance.

By choosing to study online you are the one taking charge of your education. With no physical classes or timetables to adhere to, you can study when it suits you best. Giving flexibility to those with busy work or family lives. The only deadline you’ll need to bear in mind is your exams.

What’s more, you are not alone. Should you need help or advice you can reach out to your dedicated tutor at any point for assistance. You can contact them as well as access all our engaging course materials through our online portal.

Start learning from the moment you enrol and take the next step in your financial career. When you look back in a year, you’ll be glad you did.

Additional Fees

All computer-based examinations are completed at an AAT-approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams will cost approximately £90-£120 per exam depending on the exam centre that you choose and are not included in the course fees.

AAT Remote Invigilation

AAT remote invigilation for Q2022 is available to book on the following link.

Modules

This course comprises of 4 mandatory units.

Unit 1: Introduction to Bookkeeping

On completion of this unit, you will:

- Understand how to set up bookkeeping systems

- Process customer transactions

- Process supplier transactions

- Process receipts and payments

- Process transactions into the ledger accounts

Unit 2: Principles of Bookkeeping Controls

On completion of this unit, you will:

- Use control accounts

- Reconcile a bank statement with the cash book

- Use the journal

- Produce trial balances

Unit 3: Principles of Costing

On completion of this unit, you will:

- Understand the cost recording system within an organisation

- Use cost recording techniques

- Provide information on actual and budgeted costs and income

- Use tools and techniques to support cost calculations

Unit 4: The Business Environment (Synoptic Assessment)

On completion of this unit, you will:

- Understand the principles of contract law

- Understand the external business environment

- Understand key principles of corporate social responsibility (CSR), ethics and sustainability

- Understand the impact of setting up different types of business entity

- Understand the finance function within an organisation

- Produce work in appropriate formats and communicate effectively

- Understand the importance of information to business operations

- Synoptic Assessments - Synoptic Assessments are designed to test your understanding of a range of subjects across your AAT qualification. You can take this test most weeks of the year

Entry Requirements

There are no entry requirements for this course, it is open to all.

Minimum Age restriction

You must be aged 16 or above to enrol on this course.

Average completion timeframe

The average time it takes to complete the course is 12 months.

Assessment requirements

All units in each qualification will be assessed by AAT Official CBE's (Computer Based Exams).

Exams required

Learners will undergo 4 exams, which will need to be paid for separately as they are not included as part of the course fee. Each exam costs approximately £63/£68.

Is Membership Required?

Membership is required and must be paid by the learner separately. Please see additional requirements for the exact fee.

Additional requirements

You will need a computer or laptop to study the course, and you must secure AAT Membership within 4 weeks of starting the course. Please note that the AAT Membership fee of £180 is not included in the course fee.

Certification Timeframe

It can take approximately 6 months for your certification to be delivered, but all queries must be directed to AAT student services.

Course Fees

All course fees, inclusive of all payment plans including our Premium Credit Limited option, must be settled before the final unit will be available.

*You will have access to the course for 24 months.

When studying for an AAT qualification, your knowledge and skills will be tested via computer-based assessments (CBAs). These are administered by AAT training providers or assessment centres and run entirely on PCs or laptops.

Computer-Based Assessments

AAT’s computer-based assessments are marked in one of three ways:

- Wholly computer marked, and so results will be available automatically

- Partially computer marked and partially human marked, and so results will be available within six weeks

- Wholly human marked, and so results will be available within six weeks

When are you assessed?

You will sit assessments when you are ready, as agreed with your training provider.

*The synoptic assessment for the Business Awareness unit will ask students to apply knowledge and skills gained across the qualification in an integrated way, within a workplace context. Scenarios will change over time to ensure the validity of the assessment and will be partially computer/partially human marked.

AAT Remote Invigilation

AAT remote invigilation for Q2022 will be a phased rollout from September 2023.

Fees

Additional Fees

As part of your studies, you will need to register with AAT. You can complete this quickly and easily with AAT by clicking here.

Computer-based exams are taken under invigilated conditions at an AAT approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams cost approximately £90-£120 per exam and are not included in your course fees.

AAT

Upon successful completion of this course, you will be awarded the AAT Level 2 Certificate in Accounting (Qualification Number: 603/6338/1).

AAT works across the globe with around 140,000 members in more than 90 countries. Their members, including students, are represented at every level of the finance and accounting world.

AAT members are ambitious, focused accounting professionals. Many of AAT members occupy senior, well-rewarded positions with thousands of employers – from blue-chip corporate giants to public sector institutions.

AAT qualifications are universally respected and internationally recognised. Organisations hire AAT qualified members for their knowledge, skills, diligence and enthusiasm, because AAT represents the highest standards of professionalism. In short, an AAT qualification is a route to some of the most in-demand skills in the world, and provides their students and members with a professional status to be proud of.

The Association of Accounting Technicians (AAT) is a world-renowned professional body of Accountants with members across 90 countries. As such it is one of the most widely regarded and respected accounting bodies in the world.

Whether you have a small business or want to further your accounting or bookkeeping career, gaining an AAT accredited qualification will give you the skills you need to achieve your goal.

AAT accredited qualifications are also internationally recognised, opening career opportunities around the world, and allowing you to expand your financial horizons in diverse and exciting new ways.

Once you achieve the AAT Level 2 Certificate in Accounting you should aim to apply for Trainee Accountant, or Junior Accountant roles with salaries ranging from £20,000 - £27,000 per year.

Frequently Asked Questions

Check out how this course has helped real-life learners – people just like you - to reach their goals and achieve success!

Norma

The ex Business and Management Lecturer decided to complete an AAT qualification to help her set up her own business when she moves to Jamaica in the future.

"I intend to leave this country quite soon [to move to Jamaica]. I hope if everything works out well, and when I go abroad, I might set up my own little thing. I chose AAT because I think it's international. Wherever you go, the process will be the same."

- SALE Savings End Midnight Tuesday 13th January

- SALE Savings End Midnight Tuesday 13th January

AAT Level 2 Certificate in Accounting (Q2022)

Key Points

- Take the first step towards an accounting career

- Develop a solid foundation in finance administration

- Learn about double-entry bookkeeping, using journals and controlling accounts

- Readies you for junior and entry-level accounting roles

- An internationally recognised AAT qualification

- Completion possible within a year

Studying Your Foundation Course

This course is perfect for anyone looking to put their best foot forward when it comes to starting the study journey into an accounting career. With no prior knowledge or experience required, you can get started right away and gain everything you need to get your foot in the door of the financial world.

This is the first of many available qualifications and, as an online course, it can be studied easily from home. You also don’t have to wait until you achieve higher level accounting qualifications to start working.

During the course, you will study modules like bookkeeping transactions and controls, the elements of costing and the business environment. All of this and more will give you the solid foundation you need to begin managing client books or handling your own business finances.

This online course was also developed in collaboration with accountancy employers, so you know you’re learning the skills you need to succeed in the industry.

Your 10 Step AAT Learner Journey

Your Career with AAT

Once you achieve the AAT Level 2 Certificate in Accounting you should aim to apply for Trainee Accountant, or Junior Accountant roles with salaries ranging from £20,000 - £27,000 per year.

Getting Started

learndirect is a leading UK distance learning provider. This Level 2 Certificate in Accounting is accredited by The Association of Accounting Technicians (AAT). Developed with the input of industry leaders and professionals, it gives you the best possible chance of succeeding in a career in finance.

By choosing to study online you are the one taking charge of your education. With no physical classes or timetables to adhere to, you can study when it suits you best. Giving flexibility to those with busy work or family lives. The only deadline you’ll need to bear in mind is your exams.

What’s more, you are not alone. Should you need help or advice you can reach out to your dedicated tutor at any point for assistance. You can contact them as well as access all our engaging course materials through our online portal.

Start learning from the moment you enrol and take the next step in your financial career. When you look back in a year, you’ll be glad you did.

Additional Fees

All computer-based examinations are completed at an AAT-approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams will cost approximately £90-£120 per exam depending on the exam centre that you choose and are not included in the course fees.

AAT Remote Invigilation

AAT remote invigilation for Q2022 is available to book on the following link.

Modules

This course comprises of 4 mandatory units.

Unit 1: Introduction to Bookkeeping

On completion of this unit, you will:

- Understand how to set up bookkeeping systems

- Process customer transactions

- Process supplier transactions

- Process receipts and payments

- Process transactions into the ledger accounts

Unit 2: Principles of Bookkeeping Controls

On completion of this unit, you will:

- Use control accounts

- Reconcile a bank statement with the cash book

- Use the journal

- Produce trial balances

Unit 3: Principles of Costing

On completion of this unit, you will:

- Understand the cost recording system within an organisation

- Use cost recording techniques

- Provide information on actual and budgeted costs and income

- Use tools and techniques to support cost calculations

Unit 4: The Business Environment (Synoptic Assessment)

On completion of this unit, you will:

- Understand the principles of contract law

- Understand the external business environment

- Understand key principles of corporate social responsibility (CSR), ethics and sustainability

- Understand the impact of setting up different types of business entity

- Understand the finance function within an organisation

- Produce work in appropriate formats and communicate effectively

- Understand the importance of information to business operations

- Synoptic Assessments - Synoptic Assessments are designed to test your understanding of a range of subjects across your AAT qualification. You can take this test most weeks of the year

Entry Requirements

There are no entry requirements for this course, it is open to all.

Minimum Age restriction

You must be aged 16 or above to enrol on this course.

Average completion timeframe

The average time it takes to complete the course is 12 months.

Assessment requirements

All units in each qualification will be assessed by AAT Official CBE's (Computer Based Exams).

Exams required

Learners will undergo 4 exams, which will need to be paid for separately as they are not included as part of the course fee. Each exam costs approximately £63/£68.

Is Membership Required?

Membership is required and must be paid by the learner separately. Please see additional requirements for the exact fee.

Additional requirements

You will need a computer or laptop to study the course, and you must secure AAT Membership within 4 weeks of starting the course. Please note that the AAT Membership fee of £180 is not included in the course fee.

Certification Timeframe

It can take approximately 6 months for your certification to be delivered, but all queries must be directed to AAT student services.

Course Fees

All course fees, inclusive of all payment plans including our Premium Credit Limited option, must be settled before the final unit will be available.

*You will have access to the course for 24 months.

Assessment

When studying for an AAT qualification, your knowledge and skills will be tested via computer-based assessments (CBAs). These are administered by AAT training providers or assessment centres and run entirely on PCs or laptops.

Computer-Based Assessments

AAT’s computer-based assessments are marked in one of three ways:

- Wholly computer marked, and so results will be available automatically

- Partially computer marked and partially human marked, and so results will be available within six weeks

- Wholly human marked, and so results will be available within six weeks

When are you assessed?

You will sit assessments when you are ready, as agreed with your training provider.

*The synoptic assessment for the Business Awareness unit will ask students to apply knowledge and skills gained across the qualification in an integrated way, within a workplace context. Scenarios will change over time to ensure the validity of the assessment and will be partially computer/partially human marked.

AAT Remote Invigilation

AAT remote invigilation for Q2022 will be a phased rollout from September 2023.

Fees

Additional Fees

As part of your studies, you will need to register with AAT. You can complete this quickly and easily with AAT by clicking here.

Computer-based exams are taken under invigilated conditions at an AAT approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams cost approximately £90-£120 per exam and are not included in your course fees.

Qualifications

AAT

Upon successful completion of this course, you will be awarded the AAT Level 2 Certificate in Accounting (Qualification Number: 603/6338/1).

AAT works across the globe with around 140,000 members in more than 90 countries. Their members, including students, are represented at every level of the finance and accounting world.

AAT members are ambitious, focused accounting professionals. Many of AAT members occupy senior, well-rewarded positions with thousands of employers – from blue-chip corporate giants to public sector institutions.

AAT qualifications are universally respected and internationally recognised. Organisations hire AAT qualified members for their knowledge, skills, diligence and enthusiasm, because AAT represents the highest standards of professionalism. In short, an AAT qualification is a route to some of the most in-demand skills in the world, and provides their students and members with a professional status to be proud of.

The Association of Accounting Technicians (AAT) is a world-renowned professional body of Accountants with members across 90 countries. As such it is one of the most widely regarded and respected accounting bodies in the world.

Whether you have a small business or want to further your accounting or bookkeeping career, gaining an AAT accredited qualification will give you the skills you need to achieve your goal.

AAT accredited qualifications are also internationally recognised, opening career opportunities around the world, and allowing you to expand your financial horizons in diverse and exciting new ways.

Once you achieve the AAT Level 2 Certificate in Accounting you should aim to apply for Trainee Accountant, or Junior Accountant roles with salaries ranging from £20,000 - £27,000 per year.

Frequently Asked Questions

Check out how this course has helped real-life learners – people just like you - to reach their goals and achieve success!

Norma

The ex Business and Management Lecturer decided to complete an AAT qualification to help her set up her own business when she moves to Jamaica in the future.

"I intend to leave this country quite soon [to move to Jamaica]. I hope if everything works out well, and when I go abroad, I might set up my own little thing. I chose AAT because I think it's international. Wherever you go, the process will be the same."

97.2%

97.2%

learning

learning hours

If you find this course cheaper anywhere

If you find this course cheaper anywhere